Getty image

Getty imageThe trade war between the two largest economies in the world shows that there is no sign of slowing down. Beijing swears that US President Donald Trump threatened to double China’s tariffs, and he sweared for several hours.

It can leave Most of the imports of China are faced with tremendous 104%taxes. -Requal escalation between both sides.

Who will blink first over the end of Washington, threatening Trump to introduce additional tariffs from Wednesday?

Alfredo Montufar-Helu, chief adviser of China’s China Center, said, “It would be a mistake to think China will go back and remove tariffs unilaterally.

“We will not only make China look weak, but we will give leverage to the United States to demand more. Now we have reached a trouble that can lead to long -term economic pain.”

Since last week, Trump’s tariffs in almost all countries have begun to enter into force. Asian stock I have seen the worst decline for decades on Monday It was a little recovered on Tuesday after the Trump administration was not shaken.

Meanwhile, China has returned to 34% -Tart Port, and Trump warned that if Beijing does not collapse, it will retaliate with an additional 50% tariff.

Uncertainty has increased by more than 40%of tariffs on Wednesdays to more than 40%. Many of them will reach the Asian economy. China’s tariffs will increase to 54%, while Vietnam and Cambodia’s tariffs will increase to 46%and 49%, respectively.

Experts have little time to worry about the speed that is happening, and to surprise the government, corporations and investors to adjust or prepare for other world economies.

How is China responding to tariffs?

There was China TIT-For-TAT wife responded to the first Trump tariff. In certain US imports, export control for rare metals and hemispherical managers for US companies, including Google.

This time, we announced retaliation tariffs, but it seems to relieve pain with stronger measures. It could be weakened by the currency, which is more attractive for exports to China. And the state -owned company is buying stocks that appear to be moving to stabilize the market.

Getty image

Getty imageThe outlook for negotiations between the United States and Japan was shown to investors who are fighting to withdraw some recent losses.

But confrontation between China and the United States, the world’s largest exporter and most important market, is still a big concern.

Mary Lovely, a US-QHINA trade expert in Washington DC’s Peterson Institute, said to the BBC’s NewShour program, “What we see is a game that can cause more pain.

Even in spite of Slowing economy“We can be willing to endure pain to avoid cavity frameworks for thinking of US invasion,” he added.

Chinese people do not spend enough due to the long -term real estate market crisis and unemployment increase. Debt local governments are also struggling to increase investment or expand social safety nets.

Andrew Collier at Harvard Kennedy School’s Mossavar-Rahmani business and government center said that “tariffs worsen this problem.”

When China’s exports are hit, important revenue sources harm. Exports have long been a key element of China’s explosive growth. And the state is trying to increase the manufacturing of high -end technology and domestic consumption and diversify the economy, but remains an important driver.

Collier added that it is difficult to say exactly that the tariff will not be bite soon.

It goes in two ways

But only China will feel that impact.

According to the US Trade Office, the United States imported $ 43.8 billion (£ 34 billion) from China in 2024, and exports to China were $ 14.3 billion, leaving $ 295 billion.

Getty image

Getty imageSmartphones, computers, lithium ion batteries, toys and video game consoles make up most exports to the United States. But there are many other things from screws to boilers.

And it’s not clear how the United States will find alternative supply to all these products with such a short notice.

“The tax on physical products is economically intertwined in the way there are many ways in both countries.”

?

Others around the world are watching to see where Chinese imports are going in the US market.

They will end in other markets like Southeast Asia, and ELMS added. “This place deals with your tariffs and should we think about where we can sell our products elsewhere?”

“So we are in a very different universe.

How does this end?

Unlike Trump’s first term of negotiations with Beijing, unlike the trade war with China, “It is unclear to motivate these tariffs, and it is very difficult to predict where the situation is going,” said Roland Rajah, the economist of Lowy Institute.

China added that it has a “wide tool kit” for retaliation.

“The question is how much they will be limited? There are retaliation to save the face and withdrawal of the whole. It’s not clear if China wants to go.”

Getty image

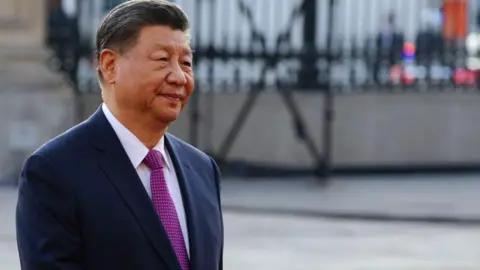

Getty imageSome experts believe that the United States and China can participate in personal dialogue. Beijing has not yet talked with XI since returning to the White House, but Beijing is willing to repeatedly sign.

But others have no hope.

ELMS said, “I think the United States is playing excessively, and she is skeptical of Trump’s belief that the US market is too advantageous, and will be bent in any China or any country.

“How will it end? Nobody knows,” she says. “I’m really worried about speed and escalation. The future is much more difficult and risk.”