This audio is generated automatically. Please let me know if you have any comments.

Alcohol sales have been sluggish in recent years, but the pain is not shared equally across the industry. Some products are seeing a surge in sales, while others continue to lose category share in c-stores.

According to a Gallup survey, 54% of Americans said they drink alcohol. “This is consistent with Americans’ growing belief that moderate drinking is bad for their health, which is now a majority view for the first time,” Gallup said.

Samantha Bomkamp Des Jardins, content marketing manager at Datassential, said broader cultural changes, including more time spent at home, increased focus on wellbeing and increased popularity of hydration, continue to influence drinking behaviour.

However, according to Datassential’s Buzz: Q2 2025 report, alcohol consumption actually realized a slight increase in the first two quarters of 2025 after a steady decline throughout 2024, suggesting a potential rebound in consumer interest, Bomkamp Des Jardins said.

C-Store Dive spoke to experts, crunched the numbers, and picked the winners and losers in the c-store alcohol space.

winner

Beer has lost ground but is still popular

According to Circana data, c-store beer sales fell 1.6% and case volume fell 3.8% for the 52 weeks ended Aug. 10, but it remains the best-selling food and beverage item in c-stores, said Mike Wyatt, Circana’s director of customer insights. Beer and related items sold more than $25 billion in C-stores last year, according to Circana data.

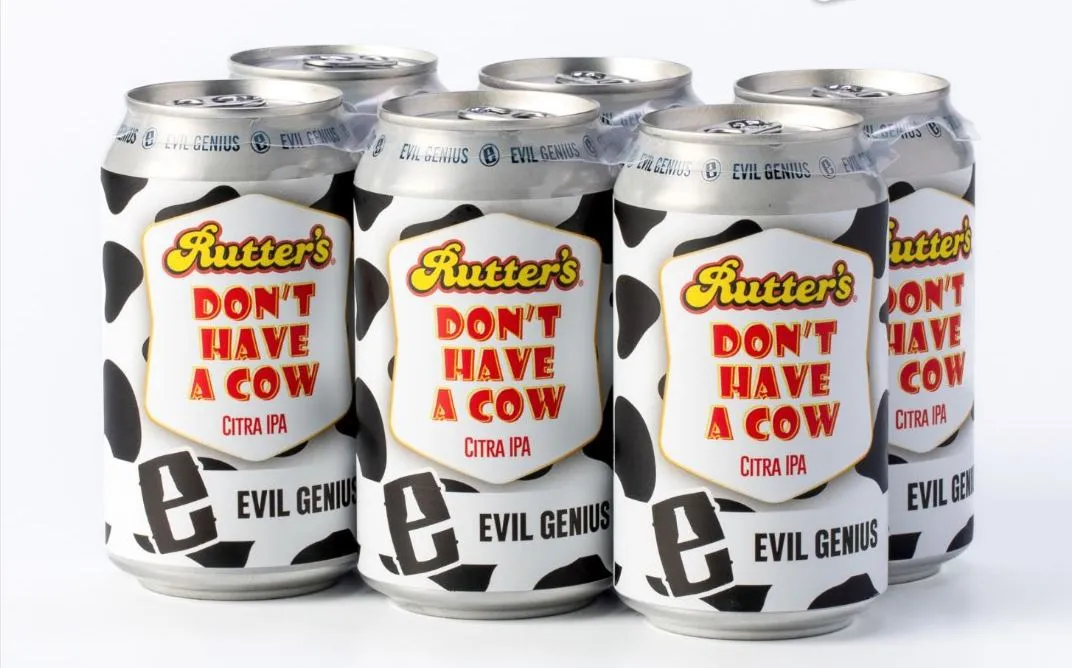

Craft beer is seeing some growth.

With permission from Rutter.

Beer is also the most widely consumed alcoholic beverage in the United States, according to Datassential. More than 80% of beer drinkers enjoy beer at least once a month, and more than half drink beer at least once a week.

Imported beers and craft beers are seeing some growth and “we’re seeing slightly better performance across all channels,” Wyatt said. A notable exception to this lukewarm trend are domestic super-premium beers like Blue Moon and Michelob Ultra, which have outpaced overall imported and craft beer sales thanks to the success of several top brands, Wyatt said.

On the other hand, according to the second quarter Goldman Sachs retailer survey, sales trends in the beer category in c-stores in the second quarter slowed slightly compared to the first quarter of this year. As a result, c-store retailers have tempered their outlook for the category this year.

RTD, liquor sales soar

Ready-to-drink alcoholic beverages and canned cocktails are almost entirely responsible for the increase in c-store alcohol sales in recent years. More than half of consumers have purchased more of these products over the past two years, reflecting increased demand for convenience and variety, Wyatt said.

Hard seltzers like White Claw and Bud Light Seltzer have seen a “stunning” 453% growth over the past four years.

Premixed cocktails like Buzzballz and BeatBox outperformed hard seltzers and flavored malt beverages, as well as the overall alcohol category, Wyatt noted. In fact, for the year ended Aug. 10, sales of premix cocktails surged nearly 56% in c-stores, with case volume up 66.5%.

Alcohol is also more popular in all types of retail stores.

Wyatt said the tequila has performed particularly well, with sales up 13.8% year-on-year due to improved quality, stronger flavor profiles and greater variety in blends.

“Tequila has become a popular drink for many consumers who have previously drank whiskey, but also for newcomers who want to try a little whiskey, which is further supported by the strong growth of tequila across multiple price points,” he said.

loser

Wine sales continue to plummet

Wine sales have been declining across all types of retail stores in recent years, and c-stores are no exception. Over the past year, dollar sales in this category have fallen 4.3%, while case sales have fallen 7%, according to Circana.

Part of the problem is that wine has more of an “intrinsic planned purchase” aspect than beer or RTDs, which doesn’t necessarily align with the wine assortment of most c-stores, Wyatt said.

Sales were further depressed by the fact that c-store assortments were down 16% over the past 36 months, while alcoholic beverages of all types were down 9%, according to Circana.

“This is being driven to a high level by c-store operators adjusting their product assortment to consumer preferences and overall trends, and rightly so,” Wyatt explained. “But this has made already negative wine trends worse.”

Some c-stores are obsessed with wine;

Provided by Circle K

Non-alcoholic wine and beer remain niche markets

Sales of low-alcohol and non-alcohol beverages continue to grow, but c-stores aren’t making as much profit as other retailers, Wyatt said. For example, low-alcohol/no-alcohol beers currently account for 2.5% of total beer sales across all channels. That’s up from 2% a year ago, but still represents just 0.3% of c-store sales.

A similar dynamic exists on the wine side, Wyatt said.

Bomkamp Des Jardins said overall non-alcoholic drinks purchases had stabilized, suggesting it was a “mature and consistent category”.

Although some categories are currently performing better than others, Wyatt cautioned against eliminating those subcategories entirely.

“Although alcohol sales have not reached the growth levels of past years, they remain a very important macro category for consumers and retailers, and the overall macro category remains strong,” Wyatt said. “We have seen changes within alcohol that make certain sectors appear to be in decline, but as consumer tastes and preferences change and new consumers enter the category, alcohol tends to bounce back.”