This audio is automatically created. Please let me know if there is feedback.

One of the fastest growing food companies in the United States is facing problems.

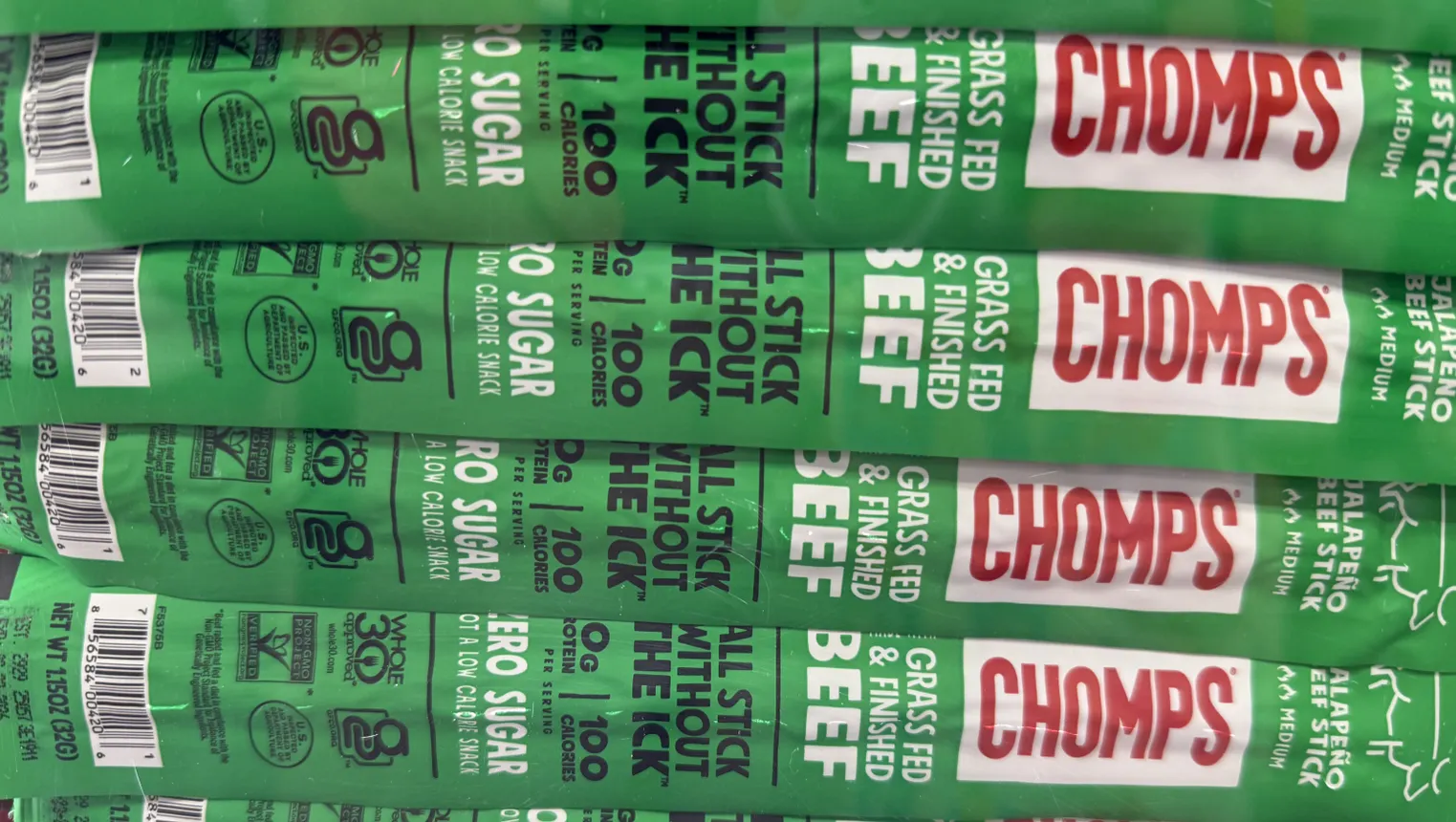

Meat stick maker Chomps produces 2 million cylindrical snacks a day, but demand is so powerful that it can only meet 85% of the order.

It is necessary to refuse the request of a new retailer who is interested in carrying the product so that it can maintain quality and keep existing customers happy. Chomps is also developing additional snacks until it enters the new geographic market and meets existing demand for core products.

Recently, the challenge faced with trouble would have been fantastic in the meat stick space where the product was once full of salt and highly processed. The meat stick is now considered as a portable and convenient snack full of protein, making the most brilliant trend in the food space.

According to Data provided by Circana, the sales of dried meat snacks except beef jerky rose to $ 3.3 billion in 2024, up 10.7% in 2024. Since 2020, this category has added almost $ 1.2 billion in sales.

Only Comps will generate nearly $ 1 billion in sales compared to $ 50 million in 2019. In 2026, we plan to add more than 22,000 new retailers, and recently, we have recently opened 300,000 square feet manufacturing facilities in Missouri to increase production “substantially”.

It is far from the flourish only meat stick producer.

JACK LINK has recently opened a $ 450 million handling plan.In Georgia to hire 800 people. and Archer Los Angeles has announced plans for the second factory, which will be almost twice the manufacturing capacity by increasing sales of 90%year -on -year.

Archer’s founder and CEO Eugene Kang said in a statement that “production capacity has increased due to the explosive growth of meat stick products.”

It pops out in a fast -growing category

Over the years, consumers have been considered to be a bad health and a lot of artificial preservatives or additives.

Matt Landen, chief vice president of business development at COMPS, said that meat sticks are difficult to eliminate this reputation and attract consumers who are hesitant.

However, it is not difficult to know why this sector has taken off as consumers demand more protein and convenience. Each chomps stick contains 10 to 12 grams of protein and is almost the same as two eggs. Recently, the meat stick sector has also risen among consumers taking GLP-1 drugs.

Landen said, “It feels like we’re building a momentum.” When you go back to the furniture penetration and how quickly we build, it feels like the wall is coming down. “

Selective caption

Christopher Doering/Food Dive

In addition to the protein, the main part of the attractiveness of meat sticks is to allow producers to meet the trends of more shopping and evolving trends.

Sticks are provided in a variety of lengths, such as Jalapeno, Tex-Mex, Smoked Mesquite and Dill Pickle. They may have low grass, organic or sodium. Some sticks can be snaps in a bite, but other sticks have a softer texture.

Vast assortment provided more reasons for consumers to switch to meat wands and helped to attract users to the category that had been hesitant in the past.

Claire Flanery, a marketing and media director of Greenridge Naturals, a Chicago meat stick, Delhi meat and sausage manufacturer, said, “There is a lot of opportunities and space for some brands.”

Conagra Brands, the owner of SLIM JIM, Duke’s and Fatty, has one of the largest and most diverse meat stick portfolios to use each brand to promote a variety of important properties that are important to consumers.

SLIM JIM emphasizes flavor and innovation, including the upcoming Buffalo Wildwings Chicken Sticks, and Fatty promotes a list of components that can be recognized in addition to the grassy beef and pork grown without antibiotics. Duke’s’ s chose to emphasize the charm of a small layout and the charm of the crafted meat stick with fresh ingredients.

Matt Brown, a brand director of SLIM JIM, said, “This provides the ability to cover more demand spaces for consumers by utilizing the right brands and products to meet consumers’ needs.

Conagra produces more than $ 1 billion in meat cane every year. Brown may be difficult to play in some products that are not related to the product, for example, a better slim jim or duke is a bold and tasty chicken stick.

Look over the meat stick

Suddenly crowded meat sticks also increase the importance of new products and find ways to differentiate yourself.

When the jerky Jack’s link changed a better LK line in 2024, this snack decided to pay more attention to the fact that there was no top nine allergens rather than using meat in grassy cows and free range chickens and turkey. Lorissa Link, the daughter -in -law of Jack Link’s founder, was diagnosed with severe food allergies and could not eat a lot of snacks in family grocery storage, including Jack’s link products.

According to Emily Arthurs, the chief director of LK snacks, the product was cooked to fill the void so that 88 million people could avoid food due to allergies or some types of intolerance due to allergies and some types of intolerance. In addition, Jack’s link provided the opportunity to establish a existence in the previously lacking natural channels.

Arthures said, “This is a true differentiation point compared to all other competitors in a better space.

However, since the meat stick manufacturer has an open slate related to innovation, some have chosen to go with a smaller mantra, especially for the taste. GreenRIDGE sells only three flavors, while ChOMPS has nine, while original varieties produce about half of sales.

Selective caption

Christopher Doering/Food Dive

Meat snack manufacturers are convinced that the strong growth trajectory will not be reduced soon. They connect with trends such as snacks, proteins and convenience, pointing out the capacity of the category that continues to resonate with consumers. This attribute helped the siphon business far from other snack categories.

For example, Kolph does not see a competitor as another meat stick manufacturer and does not regard it as another salty snack manufacturer.

He said he had never tried beef jerky of about two -thirds of Chomps’s consumers. Many of these users come from chips, bars and mixed nuts that have market share.

“We want to win in protein snacks. It’s a $ 26 billion category.” That’s why other participants (in meat snacks) see the category grows too fast. “